Content

Overview Of Order Types And Settings (Stop, Limit, Market)

However, it is necessary for buyers to keep in mind that the last-traded value just isn’t necessarily the value at which a market order shall post only is not selected, this order may execute as a taker order. be executed. It has been lively since 2015 and supports Bitcoin, Litecoin, Ether and Bcash buying and selling. Believe it or not, Coinbase Pro is owned by Coinbase, though Coinbase Pro and Coinbase don’t have much in frequent.

How much do Coinbase charge to withdraw?

Coinbase only allows you to sell directly into your Coinbase fiat wallet. However, there is no limit on the amount you can sell to your wallet. After selling to your Coinbase fiat wallet, you can opt to either withdraw funds to your US bank account or repurchase cryptocurrency on the platform.

Market Orders

Coinbase Pro is geared in direction of more superior traders, who take pleasure in immediate transactions and loads of quantity, as Coinbase Pro is among the most popular trade platforms. Coinbase is designed for ease of use, concentrating on first time consumers. Their simplistic platform makes it easy for anyone to buy or promote Bitcoin, Litecoin, Ethereum, no matter their prior expertise.

Limit Orders

We also convert market promote orders to limit orders with a 5% collar during prolonged-hours, to help cushion against the elevated volatility of the extended-hours session. During the extended-hours session, the price displayed on a stock’s Detail web page is the stock’s real-time value. Orders made exterior market hours and prolonged hours trading are queued and fulfilled either at or near the start of extended hours buying and selling or at or close to market open, according to your directions.

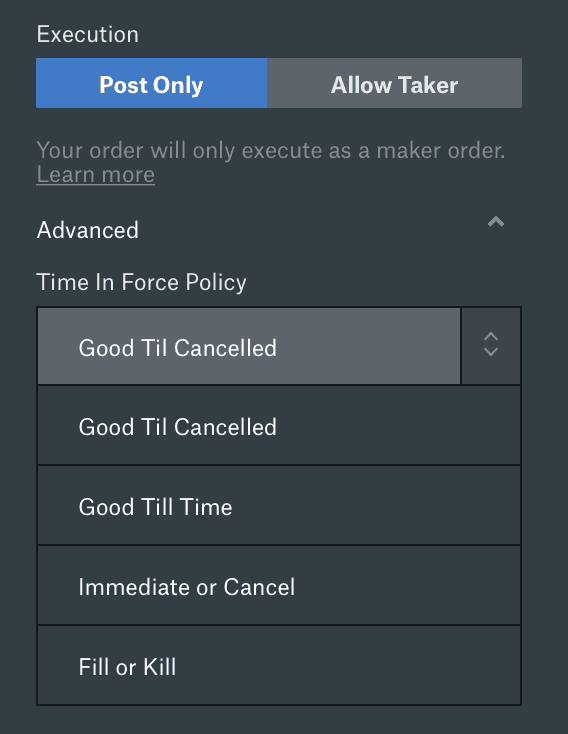

Advanced Limit Order Options

This kind of order guarantees that the order might be executed, however does not assure the execution price. A market order generally will execute at or near the current bid (for a sell order) or ask (for a buy order) price.

What is the cheapest crypto exchange?

Limit orders may cost more and command higher brokerage fees than market orders for two reasons. They are not guaranteed; if the market price never goes as high or low as the investor specified, the order is not executed.

Its buying and selling volumes are almost 30% larger when compared to the following occupant on this listing. Bitcoin accounts for almost all of the volumes at almost 29%, followed by Ripple. They store these private keys in some centralized server or database, making them easy prey for hackers.

- Except as in any other case offered within the terms of the belief, this code governs the duties and powers of a trustee, relations among trustees, and the rights and interests of a beneficiary.

- “Beneficiary” means an individual who has a present or future helpful interest in a belief, vested or contingent, or who holds a power of appointment over trust property in a capability apart from that of trustee.

- If specifically nominated within the trust instrument, a number of individuals may be designated to characterize and bind a beneficiary and obtain any notice, information, accounting, or report.

- The authorized trustee’s discover underneath this subsection doesn’t limit the best of any beneficiary to object to the exercise of the licensed trustee’s power to invade principal besides as otherwise provided in different applicable provisions of this code.

- The belief instrument may also authorize any particular person or individuals, apart from a trustee of the trust, to designate a number of persons to symbolize and bind a beneficiary and receive any discover, info, accounting, or report.

- An interest as a permissible appointee of a power of appointment, held by a person in a capacity other than that of trustee, isn’t a beneficial curiosity for purposes of this subsection.

Investors typically use a buy stop order to restrict a loss or protect a profit on a inventory that they’ve offered short. A promote cease order is entered at a stop value https://beaxy.com/ under the present market price. Investors typically use a sell stop order to restrict a loss or shield a revenue on a stock they own.

At Schwab, GTC orders expire 60 calendar days from the date the order was submitted. A purchase stop order is entered at a stop worth above the current market worth.

Day limit orders expire at the end of the current trading session and do not carry over to after-hours periods. Good-till-canceled (GTC) restrict https://www.binance.com/ orders carry forward from one standard session to the next, until executed, expired, or manually canceled by the trader.

As the media started masking Bitcoin’s important price increase, increasingly more first time patrons had been looking to purchase cryptocurrency. Coinbase is one of the hottest Bitcoin brokers – actually, its consumer base has surpassed that of inventory brokerage Charles Schwab. Coinbase’s recognition skyrocketed in 2017, along with the worth of Bitcoin. Like the common Coinbase pockets, you must belief Coinbase to secure vault funds. Coinbase is aware of your addresses and steadiness at all times and may connect this together with your id and IP tackle.

What is the cheapest way to buy Cryptocurrency?

Yes, Coinbase is a Bitcoin company based in San Francisco, and backed by trusted investors. Coinbase is the world’s largest Bitcoin broker, and also offers an exchange, wallet, and developer API.

Therefore, you must perceive the components that affect how a limit order will execute or whether or not it will execute at all. Price ceilings/price floors – The capability to set a value ceiling on a purchase, or a value flooring for a sale, is particularly important when working in a risky and/or quick-transferring market or buying and selling thinly traded points.

For instance, assume that Apple Inc. (AAPL) is trading at $170.00 and an investor desires to buy the stock once it begins to point out some serious upward momentum. The investor has put in a stop-limit order to buy with the cease worth at $a hundred and eighty.00 and the limit worth at $185.00. If the worth of AAPL moves above the $180.00 cease value, the order is activated and turns into a restrict order. As lengthy because the order may be filled underneath $185.00, which is the limit price, the commerce will be crammed.

Bitfinex is the following name on the list with a 24-hour buying and selling volume of almost $800 million. Bitcoin enjoys a greater proportion of buying and selling on this cryptocurrency exchange as it accounts for almost forty six% volumes, adopted by Ethereum and Ripple. As of this writing, Binance occupies the primary place among all the cryptocurrency exchanges with a 24-hour trading quantity of greater than $1.3 billion, and that too by a good distance.

In case the database is compromised, users of that cryptocurrency trade stand to lose their wealth in nearly no time. That’s one of many explanation why it’s at all times suggested that users shouldn’t go away their cryptocurrency of their change accounts. Unless you’re an lively trader, a great rule of thumb is to by no means go away your bitcoins or fiat cash on an change. Day buying and selling is based on technical analysis; the flexibility to make market selections based totally on value charts.

What is Coinbase withdrawal limit?

A limit order is an order to buy or sell a security at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Example: An investor wants to purchase shares of ABC stock for no more than $10.

The draw back, as with all limit orders, is that the trade is not guaranteed to be executed if the stock/commodity doesn’t attain the cease worth during the specified time interval. To assist keep away from this case, some merchants place their restrict order costs slightly above one of the best ask worth for buy limit orders or barely https://www.coinbase.com/ beneath the best bid value for promote restrict orders. This permits for a small quantity of price fluctuation while nonetheless protecting the trader from an sudden price execution. Limit orders provide many advantages, however in trade for having control over the value you’re paying or accepting, you’ll face some tradeoffs.

Limits depend on your account degree, which is set by how much info you have verified. Fully verified U.S. customers may buy up https://support.beaxy.com/hc/en-us/articles/360035208634-Post-Only-Order to $50,000 value of bitcoin day by day. Coinbase is the world’s largest Bitcoin broker, and also presents an change, pockets, and developer API.